How Uber Eats Data Scraping for Market Research Reveals 35% Pricing Trends Across Cities in 2026?

Introduction

In 2026, food delivery platforms have evolved far beyond convenience—they now serve as a rich source of real-time market intelligence. With an End-To-End Uber Eats Scraping Solution, businesses can track menu price fluctuations, delivery fee changes, and promotional strategies to uncover what influences ordering behavior and how customer preferences are shifting over time.

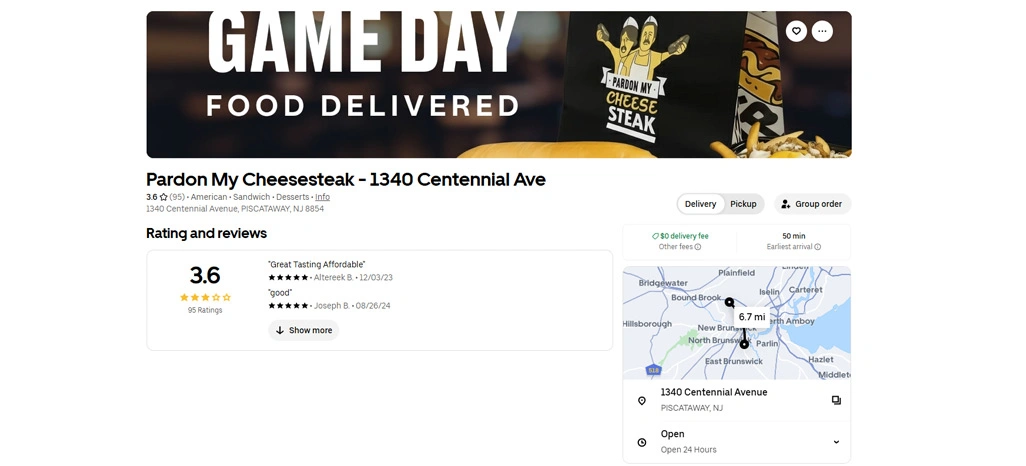

With growing competition in food delivery ecosystems, restaurant owners, cloud kitchen brands, aggregators, and analysts are now relying on data-driven methods to make smarter decisions. Using Uber Eats API Data Scraping helps in extracting structured listings, menu details, delivery charges, ratings, and restaurant availability at scale.

This blog explains how Uber Eats Data Scraping for Market Research supports city-wise competitive analysis, reveals pricing changes across regions, and highlights actionable trends using real-time datasets. When this information is collected consistently, it becomes a major advantage for pricing teams and market research professionals.

City-Level Menu Pricing Shifts and Competitive Patterns

Pricing variations across cities have become one of the strongest indicators of customer buying behavior in 2026. Recent analysis indicates that city-based food delivery pricing differences have reached nearly 35% due to inflation adjustments, demand spikes, and promotional strategies.

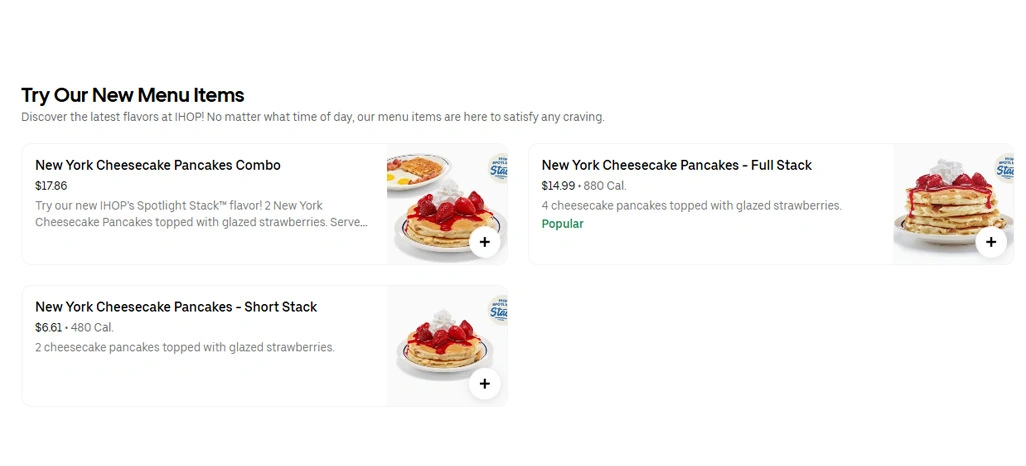

To support pricing teams and analysts, businesses now rely on Uber Eats Scraper Data that captures item-wise menu rates, discount visibility, and delivery fees on a consistent basis. This data helps compare competitor menus and detect which restaurants are frequently raising prices.

Another strong advantage is the ability to Track Uber Eats Menu Prices in Real Time, which supports daily monitoring and early detection of sudden price hikes. When menu changes happen without improvement in service or packaging quality, customer satisfaction often drops, leading to reduced ratings and fewer repeat orders.

Pricing Trend Snapshot Table (2026):

| Metric Tracked | City A (Metro) | City B (Tier-2) | City C (Tourist Hub) |

|---|---|---|---|

| Avg. Meal Price | $14.80 | $11.20 | $16.10 |

| Weekly Price Change Rate | 4.5% | 2.2% | 5.1% |

| Discount Frequency | High | Medium | High |

| Avg. Delivery Fee | $2.90 | $1.80 | $3.40 |

| Avg. Customer Rating | 4.3 | 4.1 | 4.4 |

This approach allows brands to build stronger market positioning using Restaurant Price Intelligence Using Uber Eats Data, especially when operating across multiple delivery zones. It becomes easier to identify which items should be bundled, discounted, or repositioned for better conversions.

Understanding Ordering Behavior Through Regional Insights

Food delivery demand is shifting rapidly in 2026 due to lifestyle changes, work flexibility, and increasing preference for meal bundles. For example, metro zones tend to show stronger growth in premium meals, while tier-2 markets often prefer value combos and family packs.

With structured datasets, researchers can evaluate how cuisines perform across locations and how frequently customers respond to discounts. When city-level restaurant availability is tracked, it becomes easier to spot which areas are facing delivery overload, supply shortages, or reduced restaurant participation during peak hours.

Businesses can also Analyze Food Delivery Trends Using Uber Eats Data by comparing ordering frequency, customer ratings, and delivery fee sensitivity. This method provides stronger clarity on which cuisines are saturated and which categories still have growth potential.

City-Wise Demand Behavior Table (2026):

| Category Insight | City A | City B | City C |

|---|---|---|---|

| Top Cuisine | Burgers | Indian Meals | Seafood |

| Peak Order Time | 8 PM | 9 PM | 7 PM |

| Late Night Orders Growth | +31% | +18% | +24% |

| Healthy Meals Growth | +22% | +14% | +19% |

| Avg. Weekly Active Restaurants | 8,500 | 3,200 | 5,900 |

When combined into predictive dashboards, this structured research turns into Food Delivery Data Intelligence, helping businesses forecast future meal demand and plan pricing accordingly.

Review-Based Market Research for Smarter Decisions

Market research in 2026 is becoming more dependent on real-time review behavior rather than traditional survey-based feedback. By studying review keywords, delivery complaints, portion feedback, and packaging satisfaction, brands can identify operational gaps that impact long-term performance.

A structured research method begins with Collecting Uber Eats Menu Pricing and Reviews Data, which allows analysts to connect menu changes with customer satisfaction shifts. Studies show that restaurants monitoring feedback weekly saw nearly 21% improvement in their average rating because they were able to fix recurring issues faster.

To ensure reliable research outputs, brands now invest in End-To-End Uber Eats Data Scraping for Research that captures restaurant availability, delivery charges, discounts, menu categories, and review trends in one workflow. This improves benchmarking and helps measure how competitors build customer loyalty across cities.

Review & Pricing Intelligence Table (2026):

| Research Parameter | High Performer Restaurants | Low Performer Restaurants |

|---|---|---|

| Avg. Rating | 4.5+ | Below 4.0 |

| Price Increase Frequency | Low | High |

| Common Review Mentions | Taste, Packaging | Late Delivery, Missing Items |

| Discount Strategy | Limited but targeted | Excessive and inconsistent |

| Repeat Customer Trend | Strong | Weak |

Additionally, businesses use Uber Eats Data Scraping for Consumer Insights to evaluate what drives demand shifts in metro vs suburban regions. This data helps identify what type of food categories should be expanded or repositioned based on local preferences.

How Retail Scrape Can Help You?

Modern food delivery competition requires more than guesswork and manual tracking. With Uber Eats Data Scraping for Market Research, teams can build reliable dashboards for competitive benchmarking and pricing strategy evaluation.

What we offers:

- Automated restaurant listing extraction across city zones.

- Menu-level pricing change monitoring at scale.

- Review and rating dataset collection with structured fields.

- Delivery fee tracking across time and location.

- Competitive benchmarking across restaurant categories.

- Data delivery in JSON, CSV, Excel, or API-ready formats.

With these solutions, businesses can Automate Uber Eats Restaurant Data Collection efficiently and reduce manual market research effort. It also supports Uber Eats Dataset for Academic and Business Research to help teams access reliable insights for smarter decision-making.

Conclusion

Food delivery platforms are shaping how pricing strategies evolve across cities, and restaurant brands can no longer ignore competitive pricing signals. In 2026, Uber Eats Data Scraping for Market Research plays a major role in understanding city-level menu changes, consumer demand shifts, and review-driven performance gaps that impact restaurant success.

When datasets are collected consistently, businesses can forecast demand, compare restaurant performance, and make stronger decisions using Restaurant Price Intelligence Using Uber Eats Data. If you want structured Uber Eats insights for your analytics workflows, contact Retail Scrape today and start building smarter food delivery market strategies with scalable data support.