How FMCG Data Scraping for Retail Strategy Transforms 70% of Quick Commerce Models in 2025?

Introduction

In 2025, the fast-moving consumer goods (FMCG) landscape is witnessing a massive transformation driven by Quick Commerce Data Scraping and intelligent automation. Retailers are now reimagining operations, pricing, and product placement to meet the demands of instant delivery and hyperlocal competition. With FMCG products accounting for over 60% of quick commerce orders globally, accurate data interpretation has become the backbone of operational excellence.

Through FMCG Data Scraping for Retail Strategy, businesses can capture granular insights into consumer preferences, brand visibility, and competitor performance. This structured approach helps brands streamline logistics, monitor real-time availability, and optimize supply chains. In fact, recent studies suggest that 70% of quick commerce platforms integrating data-driven strategies experience improved delivery accuracy and faster inventory turnaround.

As competition intensifies, the ability to access actionable insights determines a brand’s success. From identifying market gaps to predicting consumer demand patterns, the right data solutions are redefining FMCG growth in 2025.

Adapting to Rapid Retail Transformations in Commerce Models

The world of quick commerce is redefining how consumers shop and how brands deliver. In 2025, on-demand retail has grown from a convenience into a consumer expectation. What once was a futuristic concept—ordering essentials within minutes—has now become a global standard. Businesses are aggressively adopting data-driven methods to understand their customers better and streamline operations.

Quick Commerce Data Insights play a crucial role in helping retailers forecast demand and balance supply efficiently. Through real-time tracking and analytics, FMCG companies can evaluate product performance across multiple locations, analyze pricing trends, and identify gaps that impact delivery efficiency. As consumers increasingly prefer faster fulfillment, maintaining operational agility has become an absolute necessity.

Brands utilizing structured analytics can monitor SKU-level activity and performance, gaining a clearer understanding of which products move fastest across particular regions or timeframes. In one study, retailers that adopted advanced commerce analytics experienced up to a 25% increase in conversion rates and a 30% reduction in order delays.

| Metric | 2024 Benchmark | 2025 Trend |

|---|---|---|

| Avg. Delivery Time | 20 mins | 15 mins |

| SKU Accuracy | 85% | 94% |

| Repeat Orders | 42% | 58% |

| Forecast Accuracy | 76% | 89% |

Ultimately, using data analytics in quick commerce allows businesses to create an ecosystem that prioritizes speed, efficiency, and personalization. These insights enable them to not only meet demand but also predict and plan for it—paving the way for sustainable, profitable retail operations.

Using Advanced Analytics to Strengthen Competitive Performance

The FMCG industry is witnessing heightened competition as more players enter the digital ecosystem of instant commerce. Companies are now focusing on precision-driven decisions, drawing on automated systems that gather data across retail apps, e-commerce platforms, and localized marketplaces. This has redefined how businesses monitor competitors and adjust their strategies.

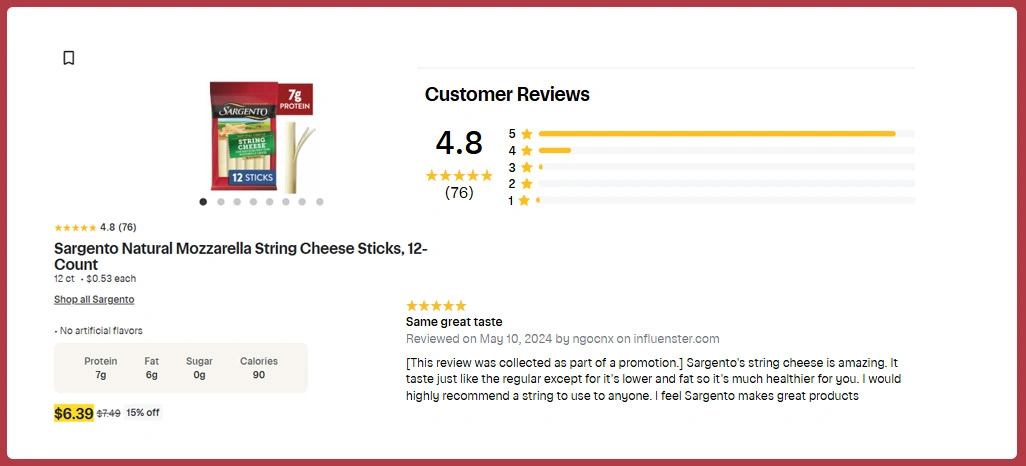

Web Scraping for FMCG Industry is helping companies gain visibility into product assortments, pricing movements, and promotional activities in real time. This allows marketing and pricing teams to react quickly, ensuring that their offerings remain relevant and competitive across channels. Automation has eliminated much of the guesswork, providing transparency into consumer responses and competitor behavior.

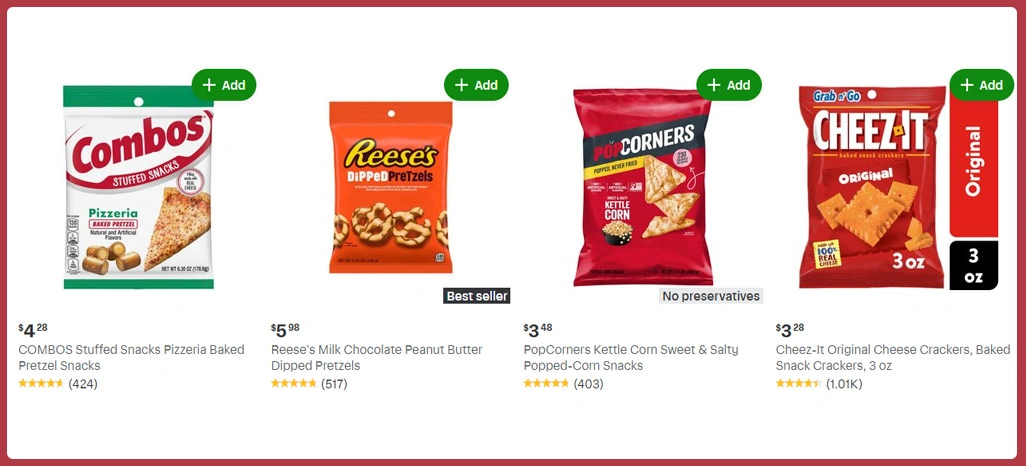

For example, analyzing competitors’ digital shelves can reveal trends like increased product bundling, time-sensitive discounts, or geographic variations in stock availability. Retailers using these insights can then optimize their pricing matrix, refine discount schedules, and rebalance inventory across warehouses. This agility provides a direct edge in maintaining consumer loyalty and profitability.

| Data Element | Insights Extracted | Strategic Use |

|---|---|---|

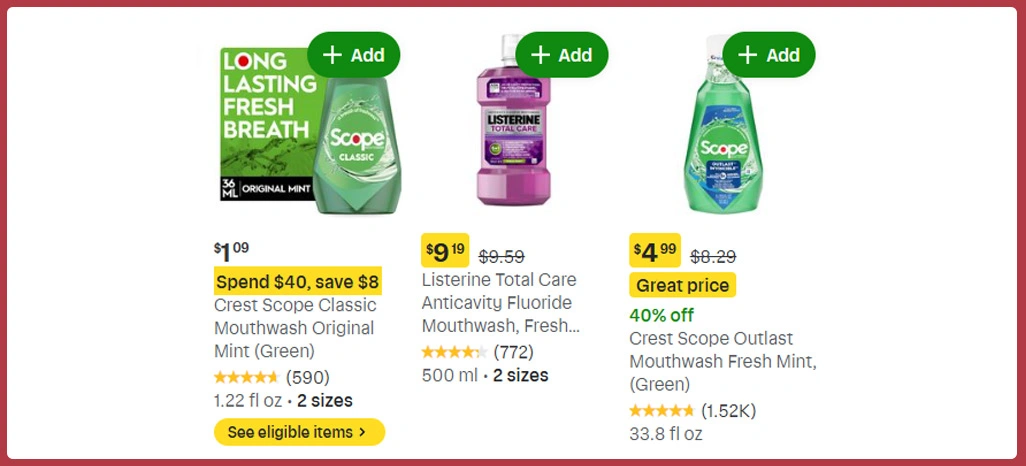

| Pricing Variations | ±3% across zones | Dynamic pricing |

| Product Reviews | 4.2 avg. rating | Quality consistency |

| Stock Levels | 82% maintained | Availability tracking |

| Promotion Frequency | 12/month | Marketing optimization |

Through the integration of Quick Commerce App Data Analysis, companies are able to turn raw information into strategic intelligence—building models that enhance profitability and sharpen competitive advantage in today’s fast-paced retail world.

Understanding Customer Behavior to Drive Hyperlocal Growth

The evolution of consumer behavior within instant retail has given rise to a data-centric approach for understanding and responding to customer needs. Brands today can no longer depend solely on traditional surveys or sales data; instead, they rely on real-time behavioral analytics to decode purchasing intent and timing.

By examining Quick Commerce Consumer Behavior Trends, companies can gain meaningful insights into when and how consumers engage with products. Patterns vary drastically by region—urban consumers prioritize time efficiency and digital convenience, while suburban markets often lean toward household essentials and planned purchases. This distinction directly influences assortment planning, pricing, and distribution strategy.

Real-Time FMCG Data Collection enables brands to identify such distinctions dynamically. For instance, retailers can track consumption patterns by time of day or local events, leading to precise demand forecasting. With accurate consumer mapping, logistics teams can ensure that stock replenishment aligns with demand peaks, minimizing both shortages and overstock.

| Factor | Urban | Suburban |

|---|---|---|

| Instant Snack Demand | 68% | 42% |

| Beverage Orders | 56% | 47% |

| Household Essentials | 49% | 63% |

| Repeat Buyers | 61% | 39% |

The future of consumer engagement in quick commerce lies in localization—adapting to each micro-market’s unique rhythm. When brands decode these behavioral insights effectively, they not only enhance the shopping experience but also build trust and loyalty through timely, data-driven fulfillment.

Driving Smarter Product and Category Decisions through Analytics

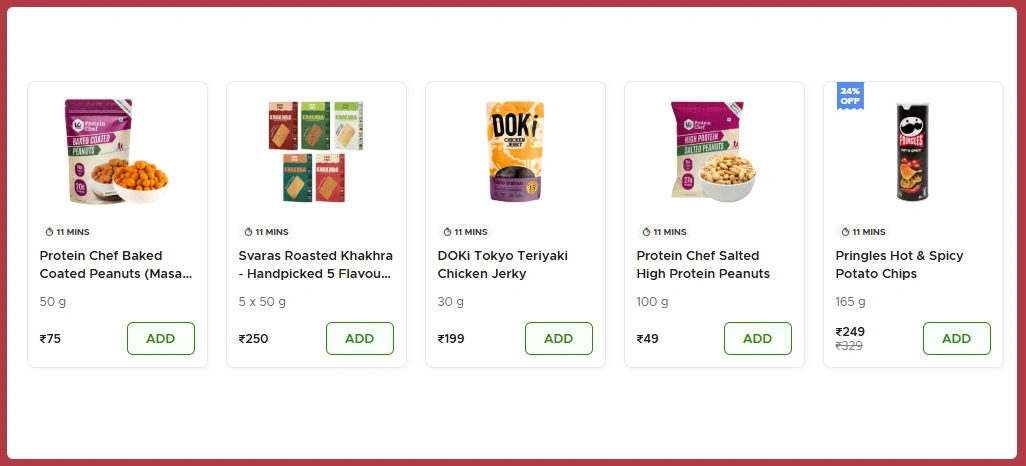

The modern quick commerce ecosystem thrives on data that guides product performance and assortment efficiency. Today, brands must identify which products attract engagement, generate consistent sales, and maintain stock rotation across multiple delivery platforms.

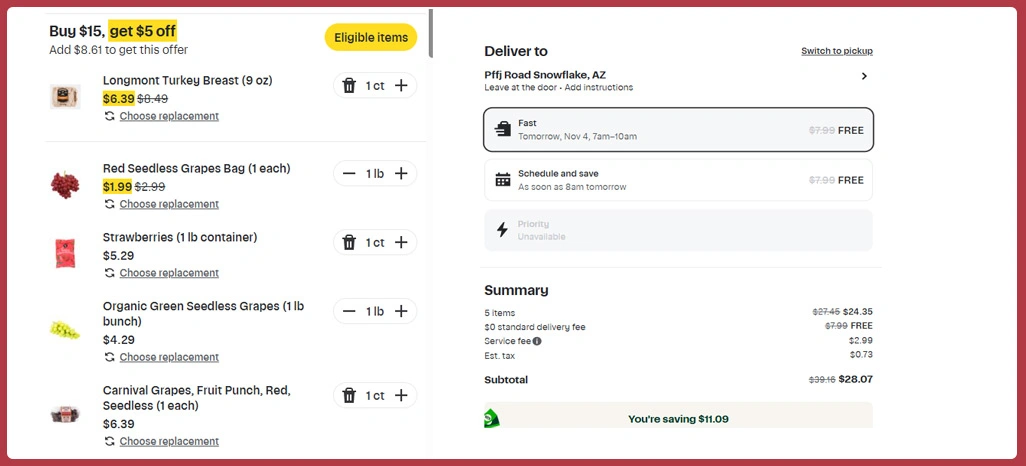

Using Quick Commerce Datasets, companies can compare cross-channel data to determine which SKUs should be prioritized in marketing and logistics. When managed effectively, this enables stronger brand positioning and faster response to customer preferences. Real-time tracking also allows managers to pinpoint underperforming items and take corrective actions through promotions or restocking strategies.

Market research highlights that businesses relying on structured analytics experience 20–25% improved sales efficiency. This shift comes from greater visibility into product lifecycles and more informed decisions around pricing and shelf management.

| Product Category | Engagement Rate | Stock Turnover |

|---|---|---|

| Snacks | 72% | 5.2 days |

| Beverages | 65% | 6.8 days |

| Dairy | 58% | 7.5 days |

| Personal Care | 49% | 8.1 days |

Through the application of Quick Commerce Retail Analytics, companies can unify their marketing, merchandising, and operational teams under one data-driven strategy. It encourages predictive decision-making that enhances assortment optimization and long-term profitability.

Managing Price Volatility and Market Response in Real Time

Pricing remains one of the most sensitive and competitive elements of FMCG retail. With so many rapid shifts in market dynamics, companies are adopting predictive tools to forecast and adjust prices in near real time.

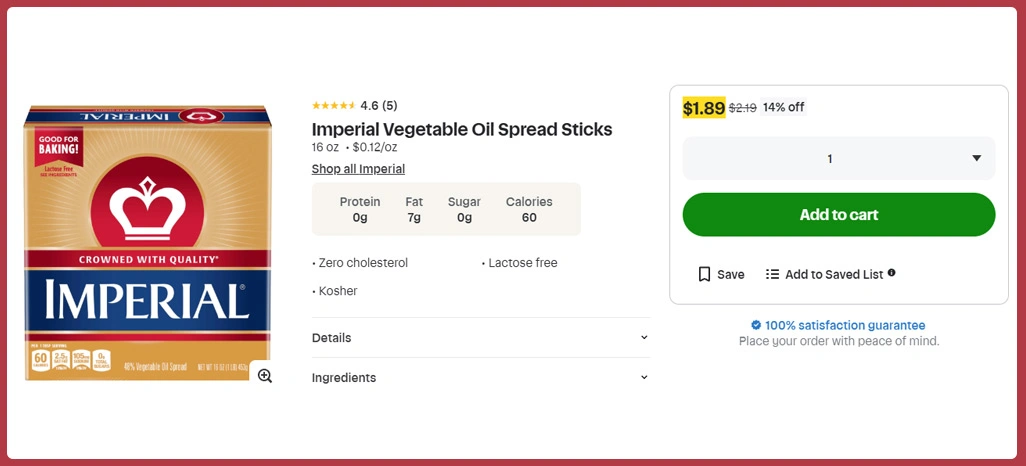

Real-Time Price Monitoring provides visibility into competitor actions, regional price fluctuations, and seasonal demand surges. When analyzed accurately, these datasets help companies understand how pricing changes impact customer acquisition and retention.

By combining analytics with automation, brands can simulate different price scenarios, identify the most profitable ranges, and execute price updates across all channels instantly. This adaptive approach ensures that businesses stay aligned with consumer expectations without compromising margins.

| Market Aspect | Impact Level | Strategic Action |

|---|---|---|

| Sudden Price Drops | High | Automated re-pricing |

| Seasonal Surge | Medium | Temporary discounting |

| Competitor Launch | High | Promotional bundles |

| Stock Overload | Medium | Flash sale triggers |

Incorporating Real-Time FMCG Pricing and Stock Data helps brands evaluate both pricing and inventory impacts simultaneously, enabling more balanced and resilient pricing frameworks. In 2025, agile pricing has become not just a differentiator—but a survival strategy in the ever-evolving commerce ecosystem.

Maximizing Localized Retail Performance through Micro-Market Intelligence

Local market intelligence has emerged as a major driver of quick commerce success. Retailers who understand regional buying behaviors can adapt their offerings to match consumer needs precisely.

By analyzing FMCG Product Demand Insights India, businesses have recognized that preferences shift not just by region, but by city, neighborhood, and even time of day. This insight is shaping how companies plan inventory, manage delivery routes, and execute promotional campaigns.

Hyperlocal targeting is particularly impactful for cities like Mumbai, Delhi, and Bengaluru—where distinct consumption patterns define daily sales cycles. For example, high beverage demand in Bengaluru during summer months contrasts with stronger dairy product performance in Delhi year-round.

| City | Avg. Order Value | Most Ordered Category |

|---|---|---|

| Mumbai | ₹615 | Snacks |

| Delhi | ₹580 | Dairy |

| Bengaluru | ₹640 | Beverages |

| Pune | ₹590 | Household Items |

With Hyperlocal Grocery Analytics, businesses can achieve remarkable efficiency by optimizing delivery density, stocking relevant items, and tailoring offers that resonate with specific communities. This micro-level intelligence doesn’t just improve profitability—it elevates consumer satisfaction by ensuring every order reflects local demand realities.

How Retail Scrape Can Help You?

We enable businesses to transform decision-making by integrating FMCG Data Scraping for Retail Strategy into their digital framework. We deliver automated data pipelines that extract, clean, and structure data from multiple quick commerce and FMCG sources, ensuring unmatched accuracy and speed.

Our solutions help you:

- Track real-time product listings and promotions across multiple retail apps.

- Analyze competitor pricing to build data-backed strategies.

- Forecast demand variations using predictive analytics.

- Synchronize stock updates with actual sales performance.

- Enhance operational efficiency through automated dashboards.

- Improve customer experience with accurate data-driven insights.

By empowering your teams with intelligent analytics and integrating Quick Commerce Retail Analytics, we ensure that your business decisions are faster, sharper, and more profitable.

Conclusion

In a competitive environment where adaptability defines market success, businesses embracing FMCG Data Scraping for Retail Strategy gain measurable advantages in speed, accuracy, and responsiveness. These solutions simplify data interpretation and convert real-time insights into actionable strategies that strengthen retail competitiveness.

Integrating technologies like Quick Commerce App Data Analysis enhances inventory precision, customer experience, and delivery efficiency. To scale your data-driven retail transformation, connect with Retail Scrape today and power your growth with precision analytics.