How 27% Supermarket Savings Emerge from Australian Grocery Pricing Across Coles, Woolworths, and Aldi?

Introduction

Australian grocery shoppers are becoming more price-conscious than ever, especially as everyday essentials like dairy, pantry staples, and fresh produce continue to fluctuate across major supermarket chains. What many households don’t realize is that small differences in weekly pricing can create major savings opportunities when tracked consistently.

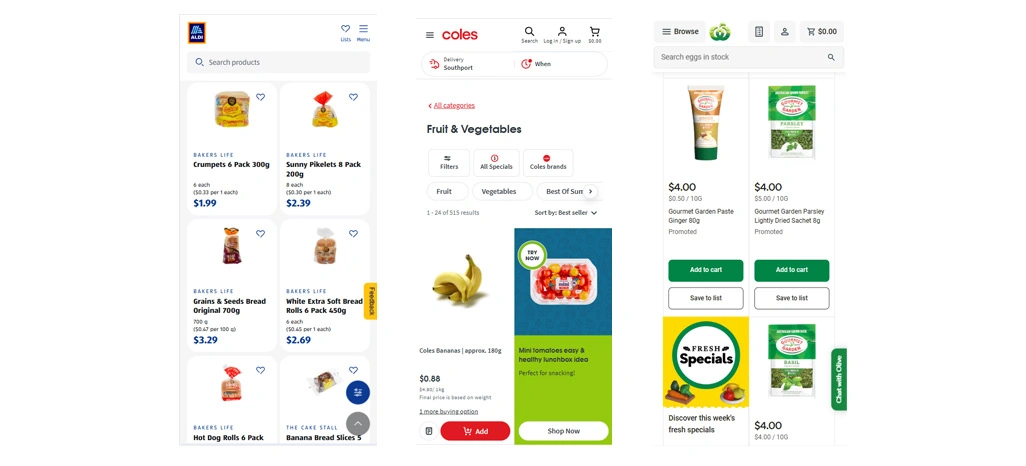

The growing demand for Real-Time Grocery Price Tracking Australia is directly linked to rising consumer sensitivity, as people now compare cart totals before committing to a single supermarket. Coles, Woolworths, and Aldi dominate the market, yet each follows different promotional strategies, private-label pricing models, and discount cycles.

That’s why tracking Australian Grocery Pricing Across Coles, Woolworths, and Aldi is no longer just a consumer habit, but a strategic market intelligence practice. With real-time insights and structured analysis, businesses, brands, and consumers can identify patterns, evaluate competitor movements, and make faster buying decisions based on actual price differences rather than assumptions.

Understanding Essential Category Price Differences Clearly

Australian households often assume grocery pricing is consistent across major chains, but real savings appear when core essentials are compared side by side. Aldi typically maintains lower baseline pricing because of limited SKUs and strong private-brand focus, while Coles and Woolworths rely more on rotating catalog offers that shift weekly.

To capture these shifts accurately, businesses increasingly rely on Supermarket Data Scraping Australia to collect structured product-level pricing. For example, pantry staples and dairy products frequently show predictable price gaps, while frozen food and personal care items tend to change more frequently based on campaign cycles.

This is where Coles vs Woolworths vs Aldi Pricing becomes a practical benchmark. Instead of focusing on single products, basket-level analysis provides clearer evidence of where savings actually come from. Many shoppers reduce spending by switching only a handful of repeat-purchase items to the lowest-cost chain, creating consistent savings without changing their entire shopping routine.

Category-Level Pricing Gap Snapshot:

| Grocery Category | Coles Price Index | Woolworths Price Index | Aldi Price Index | Typical Weekly Gap |

|---|---|---|---|---|

| Dairy Essentials | 100 | 102 | 92 | 8% to 10% |

| Pantry Staples | 100 | 101 | 89 | 10% to 13% |

| Frozen Products | 100 | 103 | 94 | 6% to 9% |

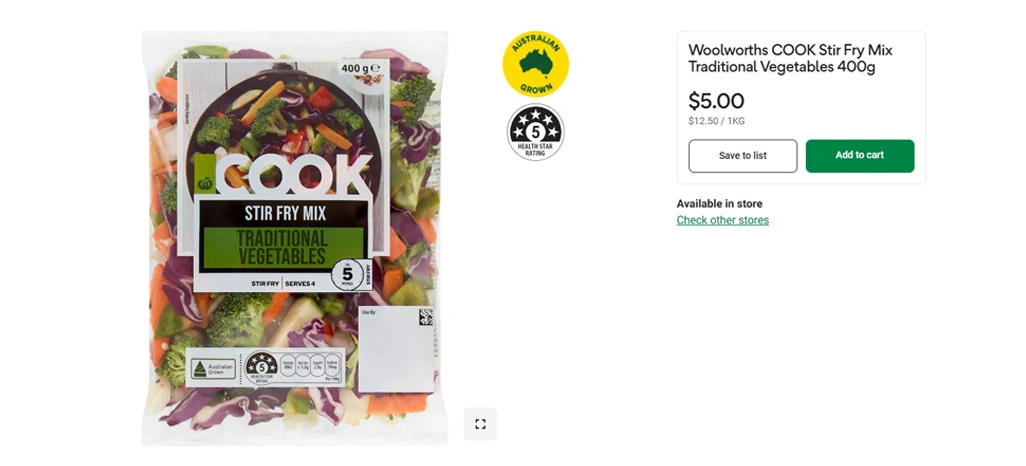

| Fresh Produce | 100 | 98 | 96 | 2% to 5% |

| Household Cleaning | 100 | 105 | 91 | 10% to 14% |

Additionally, brands and analysts can apply Real-Time Australian Grocery Pricing Comparison to evaluate pricing competitiveness, track undercutting patterns, and measure category performance across retailers.

Tracking Weekly Promotions and Price Movements

Categories such as snacks, beverages, toiletries, and packaged foods often show the highest volatility. Woolworths frequently uses short-term markdown strategies, while Coles focuses more on multi-buy deals and limited-time savings bundles. Aldi, however, usually holds steady and competes through consistent private-label affordability.

For businesses monitoring competitor strategy, Australian Grocery Price Monitoring helps measure how price drops occur over time and how long promotional discounts remain active. Instead of relying on visible discounts alone, analysts can measure real price movement and determine whether a promotion is truly valuable or simply marketing-driven.

Using Weekly Grocery Price Changes Australia, brands can identify recurring discount cycles and predict when specific product groups are most likely to drop. This supports smarter inventory planning and helps FMCG brands time their promotions to match consumer buying behavior.

Weekly Promotional Price Shift Overview:

| Product Category | Coles Avg Weekly Shift | Woolworths Avg Weekly Shift | Aldi Avg Weekly Shift | Discount Pattern Frequency |

|---|---|---|---|---|

| Breakfast Cereal | -6% | -9% | -2% | Every 2 weeks |

| Soft Drinks | -5% | -11% | -1% | Weekly |

| Packaged Snacks | -4% | -7% | -1% | Every 1–2 weeks |

| Toiletries | -3% | -6% | 0% | Every 3 weeks |

| Coffee & Tea | -5% | -8% | -1% | Every 2–3 weeks |

Additionally, retailers can improve campaign evaluation using Grocery Discount Tracking Australia, ensuring their discounts are aligned with category expectations rather than random markdowns.

Comparing Total Basket Costs for Savings

Many shoppers focus on individual product pricing, but real supermarket savings are best measured through basket comparisons. Aldi usually performs strongly in private-label staples, while Coles and Woolworths can occasionally offer lower cart totals when promotions heavily reduce branded goods.

Through structured analysis, Australia Supermarket Price Comparison helps evaluate which retailer performs best across different basket types. Instead of relying on assumptions, analysts can measure real-world pricing impact across 20-item, 50-item, or monthly bulk baskets.

One consistent insight is that savings increase significantly when shoppers split purchases strategically. Essentials and cleaning products may be purchased from Aldi, while select promotional branded products are purchased from Coles or Woolworths. This hybrid strategy often delivers the highest cost reduction.

25-Item Basket Cost Comparison Snapshot:

| Basket Type | Coles Basket Total (AUD) | Woolworths Basket Total (AUD) | Aldi Basket Total (AUD) | Estimated Savings Range |

|---|---|---|---|---|

| Essentials Basket | 92.50 | 94.20 | 78.90 | 14% to 18% |

| Mixed Family Basket | 165.40 | 171.80 | 138.70 | 16% to 20% |

| Brand-Focused Basket | 142.60 | 139.90 | 136.20 | 3% to 5% |

| Household + Grocery Basket | 198.30 | 205.10 | 162.40 | 18% to 22% |

| Monthly Bulk Basket | 320.80 | 331.40 | 259.70 | 20% to 27% |

Using this method, many consumers identify the Cheapest Supermarket in Australia based on their personal basket structure, rather than choosing one chain blindly.

How Retail Scrape Can Help You?

With automated collection systems, we enable deeper evaluation of Australian Grocery Pricing Across Coles, Woolworths, and Aldi while ensuring that the data remains consistent, scalable, and decision-ready for analytics teams.

We help grocery brands and retail intelligence teams through:

- Extracting product pricing and unit pricing across multiple stores.

- Capturing weekly promotion patterns and discount depth shifts.

- Monitoring category competitiveness and price positioning.

- Identifying private label vs branded pricing gaps.

- Supporting competitor benchmarking for retail strategy planning.

- Building historical datasets for long-term pricing trend forecasting.

This is especially effective for brands and analysts focused on Grocery Discount Tracking Australia to measure real discount performance across retailers.

Conclusion

When households and businesses evaluate Australian Grocery Pricing Across Coles, Woolworths, and Aldi, they can clearly identify where staples are cheaper, where promotions are strongest, and which categories deliver the most repeatable value across weekly shopping cycles.

A structured approach powered by Real-Time Australian Grocery Pricing Comparison makes it easier to quantify savings opportunities, validate discount performance, and improve grocery spending decisions at scale. Contact Retail Scrape today and turn pricing data into measurable retail strategy outcomes.