How Do Ajio and Myntra Festival Sale Insights Uncover 50% Off Trends in Fashion Price Drops?

Introduction

Festive seasons in India bring a surge of online fashion shopping, where customers eagerly await massive discounts and exclusive deals. With shoppers making data-driven purchase decisions, businesses are focusing on precise tracking of pricing and product movement during these high-traffic periods. Ajio and Myntra festival sale data provide an analytical edge to decode how consumer behavior, price fluctuations, and trend shifts occur across different apparel categories during the festival months.

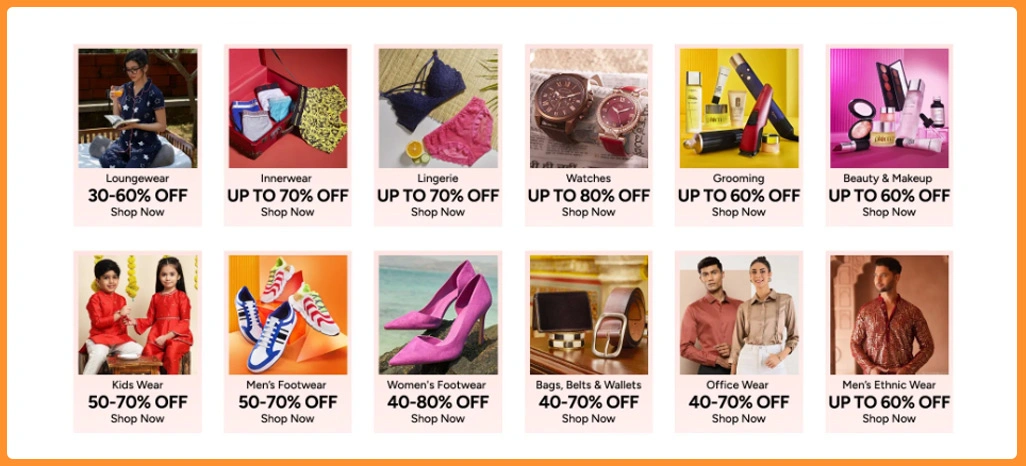

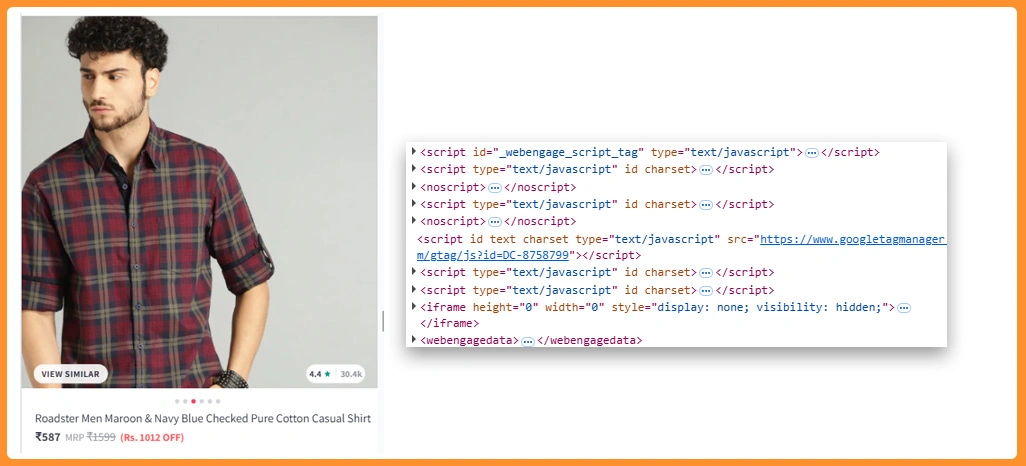

By using E-Commerce Data Scraping, brands and analysts can assess how specific clothing items perform during flash sales, how discount ranges evolve, and what pricing strategies outperform others. These insights help identify 50% off patterns, seasonal bestsellers, and pricing elasticity across categories like ethnic wear, western wear, and accessories.

The evolving digital retail ecosystem of India shows that competitive pricing isn’t just about offering discounts—it’s about understanding when and how customers respond. With Ajio and Myntra Festival Sale Insights, retailers can plan profitable promotions, optimize product placements, and predict what customers will buy next, empowering them to turn seasonal trends into long-term revenue opportunities.

Consumer Reactions to Seasonal Price Adjustments

The festive shopping season across India sparks a competitive digital rush as fashion retailers strive to captivate buyers with irresistible deals and time-sensitive promotions. Understanding customer reaction patterns to these strategic price shifts is vital to shaping profitable sale events.

A closer examination of buyer engagement during festive sales highlights that nearly 60% of purchases occur after the initial 72 hours of sale openings. This indicates that shoppers wait for deeper markdowns and price stabilization before committing to a purchase.

| Metric | Observation | Impact |

|---|---|---|

| Average price drop per product | 38% | Encourages higher cart additions |

| Peak discount window | 3–5 | Drives 60% total orders |

| Conversion rate increase | 25% | Boost from repeat visitors |

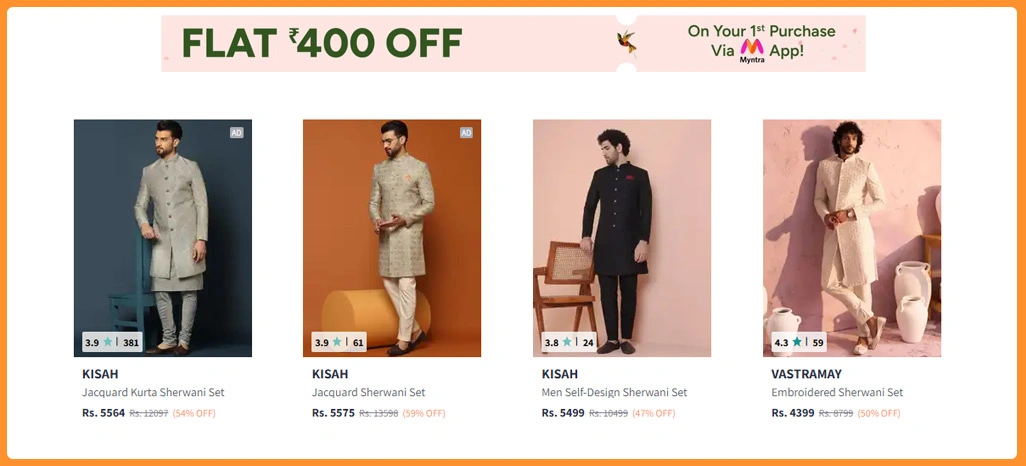

| Fashion category with max traction | Women’s Ethnic Wear | 47% sales share |

By examining Festival Fashion Discounts India, retailers can uncover patterns in buying preferences that reflect how Indian consumers respond to progressive pricing strategies. Such insights play a crucial role in building more impactful festival sale campaigns, enabling retailers to deliver meaningful offers at the right moment.

When analyzed with advanced methodologies, these data points reveal consumer psychology behind delayed purchase behavior—ultimately empowering fashion platforms to balance excitement with profitability while aligning discounts with customer intent and festival-specific demand cycles.

Category-Level Trends and Repeat Purchase Behavior

The dynamics of online fashion retailing depend heavily on category-based performance during high-demand festive seasons. Each product segment experiences its own pricing elasticity and consumer retention curve. With Myntra Fashion Sale Analytics, data analysis becomes a tool for identifying which categories sustain momentum after the initial sale rush.

Insights show that mid-range discounts yield stronger repeat purchase tendencies compared to heavy markdowns. Conversely, balanced discounts of 25–40% foster trust, encouraging customers to revisit platforms post-sale. This pattern has been validated through datasets compiled from Myntra Product Data Scraping, which captures variables such as average selling price, markdown percentage, and purchase recurrence.

| Category | Discount Range | Repeat Purchase % | Price Retention Score |

|---|---|---|---|

| Ethnic Wear | 25–35% | 41% | 4.2/5 |

| Western Wear | 30–40% | 37% | 4.0/5 |

| Footwear | 20–25% | 29% | 3.8/5 |

| Accessories | 35–45% | 33% | 3.9/5 |

Through Fashion E-Commerce Data Scraping, brands gain visibility into category trends that define loyalty drivers and profit consistency. These insights empower merchandising teams to adjust product visibility, prioritize profitable categories, and analyze the correlation between discount magnitude and consumer retention.

The findings reflect that strategic moderation in pricing is more sustainable than aggressive markdowns, ensuring revenue consistency while maintaining shopper confidence. Ultimately, identifying these trends enhances the capability of fashion e-commerce firms to create more predictive pricing and inventory models that resonate with festive buying habits.

Analyzing Discount Patterns and Price Sequencing Tactics

Online fashion platforms thrive on precision discounting, where success depends not only on the discount percentage but also on its timing and communication. A deep evaluation of Ajio’s pricing rhythm highlights how progressive markdowns optimize sales momentum. Ajio’s data demonstrates that moderate, time-phased discounting creates a balanced ecosystem for both consumer satisfaction and profit margins.

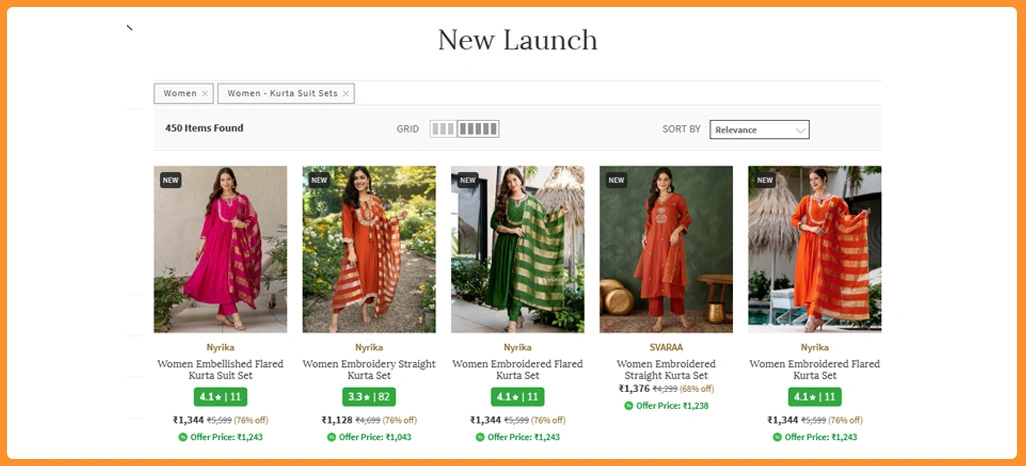

Data extracted through Ajio Product Data Scraping provides clarity on how price sequencing influences conversion rates and average order values. These analyses reveal that “Fresh Festive Arrival” listings often outperform heavily discounted items because consumers perceive them as premium yet affordable.

| Discount Range | Average Order Value | Engagement Rate | Return Frequency |

|---|---|---|---|

| 10–20% | ₹1,850 | 45% | 8% |

| 21–35% | ₹2,450 | 58% | 10% |

| 36–50% | ₹2,900 | 63% | 14% |

The integration of Price and Discount Tracking Ajio systems allows retail teams to measure real-time profitability while reducing the risk of stock accumulation. These insights form the foundation for smarter campaign orchestration during Festive Clothing Sale India Online events.

By assessing factors like user engagement frequency, conversion rates, and repeat buying behavior, Ajio’s pricing model demonstrates that data-driven sequencing can sustain consumer enthusiasm throughout multi-day sale events while maintaining revenue equilibrium.

Data-Driven Seasonal Analysis and Product Volatility

Seasonal fluctuations play a defining role in shaping apparel sales performance during festival periods. Advanced analytics show that demand surges for select categories like ethnic wear and footwear are directly linked to pricing agility. By implementing Web Scraping E-Commerce Datasets, businesses can identify these fluctuations and measure how quickly buyers react to pricing changes across different apparel segments.

This analytical perspective uncovers that newly introduced items—especially those launched within two weeks of the festival—perform significantly better. Products entering the marketplace during this critical timeframe exhibit 28% higher conversions compared to those introduced earlier. Similarly, dynamic pricing techniques used during this phase improve margin gains by 19%, reinforcing the value of adaptive price strategies.

| Parameter | Insight | Growth Impact |

|---|---|---|

| New launch conversion | +28% | Higher profitability |

| Seasonal adjustment | 1.8x | Faster stock rotation |

| Elastic pricing response | +19% | Improved ROI |

| Discount revision impact | 14% | Better sell-through |

Using insights extracted from Festival Season Fashion Trends India, retailers can align product introductions with buyer expectations. When analyzed through real-time data collection, pricing trends reveal the importance of launch timing, elasticity, and inventory turnover.

These patterns suggest that success is not limited to discount depth but also hinges on the synchronization of release dates, promotional messages, and market readiness. Seasonal analytics hence act as a strategic compass for predicting which items will drive engagement and profitability throughout festive cycles.

Predictive Analytics for Pricing and Discount Modeling

The integration of technology-driven forecasting has transformed retail pricing management. Through advanced automation frameworks, predictive systems can anticipate optimal discount intervals and detect the best timing for markdowns. Using E-Commerce API Scraping, companies extract continuous datasets from multiple platforms to strengthen prediction accuracy and streamline strategy deployment.

When comparing predictive discount modeling to traditional methods, data accuracy rises substantially, allowing retailers to plan more confidently. Automated models deliver real-time updates that eliminate manual discrepancies and ensure faster reaction to market signals. As a result, pricing decisions become proactive rather than reactive, leading to higher conversion rates and reduced return ratios.

| Function | Traditional Accuracy | Predictive Model Accuracy |

|---|---|---|

| Discount Optimization | 61% | 87% |

| Product Trend Prediction | 67% | 84% |

| Buyer Conversion Forecast | 70% | 92% |

| Return Rate Estimation | 58% | 81% |

These automation-driven processes have revolutionized Online Fashion Sale India performance analysis by linking consumer data with predictive algorithms. The ability to identify the ideal markdown timing enhances business agility and inventory turnover.

Moreover, predictive accuracy in pricing ensures that retailers maintain an equilibrium between profit and value delivery, giving them a data-backed edge in managing festival-season volatility. This systematic approach not only enhances revenue consistency but also builds consumer loyalty by aligning pricing expectations with actual demand cycles.

Post-Festival Apparel Analysis and Market Retention Study

After the festive season concludes, understanding post-sale behavior is crucial to sustaining profitability. Analyzing how various fashion categories perform after major events provides insights into brand strength and long-term retention potential. Post-sale datasets reveal that several apparel types continue performing well weeks after the festive window closes, indicating consistent customer engagement beyond immediate promotions.

For example, ethnic wear maintains a 15% sales rate post-event, while accessories and footwear also sustain extended visibility periods. The following table represents the post-sale growth rate, retention period, and restocking necessity for key product categories.

| Product Type | Post-Sale Growth | Retention Period | Restock Necessity |

|---|---|---|---|

| Ethnic Wear | +15% | 20 Days | Medium |

| Western Wear | +10% | 15 Days | High |

| Accessories | +12% | 25 Days | Low |

| Footwear | +9% | 18 Days | Medium |

Through Using Web Scraping for Fashion Sale Data, these findings can be systematically measured and forecasted, allowing for better post-event inventory allocation. Retailers identify what continues to perform well even without promotional support, revealing long-term consumer preferences.

Analyzing Clothing and Apparel Sale Trends post-festival aids in building adaptive replenishment models that anticipate repeat demand, reducing wastage and stockouts. This process also supports smarter marketing re-engagement strategies, ensuring that customer interest cultivated during festivals translates into consistent sales performance afterward.

How Retail Scrape Can Help You?

As the fashion e-commerce industry grows more dynamic, analyzing Ajio and Myntra Festival Sale Insights requires powerful scraping and analytical frameworks. We enable brands, analytics firms, and retail strategists to collect, process, and interpret real-time data from diverse fashion marketplaces.

With our automated data scraping services, you can:

- Extract structured datasets from multiple e-commerce platforms.

- Identify and compare discount timelines for competitive fashion products.

- Monitor product availability, pricing shifts, and performance.

- Build historical datasets for seasonal price trend forecasting.

- Create interactive dashboards to visualize real-time festival sale metrics.

- Gain predictive insights for category-level profit analysis.

We help translate large-scale data into decision-oriented insights that support smarter retail growth and informed marketing planning. Our solutions can also be customized for analyzing Festive Clothing Sale India Online patterns, helping brands tailor their strategies effectively across platforms and categories.

Conclusion

The deep analytical potential of Ajio and Myntra Festival Sale Insights lies in how businesses interpret shopper intent, discount pacing, and product appeal across high-traffic sale events. Retailers who act on these findings can implement more adaptive and profitable pricing structures while ensuring that festival promotions translate into measurable value.

Moreover, insights drawn from Festival Season Fashion Trends India empower brands to strengthen product positioning and seasonal strategies, creating consistency across their digital presence. Contact Retail Scrape today to decode your fashion data and transform festive sale insights into real business growth.